Tax Rules

Tax Rules allow you to overrule the default VAT rate of products. This is used:

- For shops with country-specific VAT rates (e.g. Netherlands 21%, Germany 19%).

- For EU customers with delivery addresses in other EU countries (the so-called Intra-Community supplies). These customers/addresses need to be linked to the applicable tax rule when one of the following conditions apply:

- You deliver goods to another EU country. You must be able to show this in your administration (e.g. order forms, order confirmations, and transport documents).

- Your customer represents a business and has a VAT identification number in the country of delivery.

For B2C shops (prices including VAT) you can set tax rules at shop level.

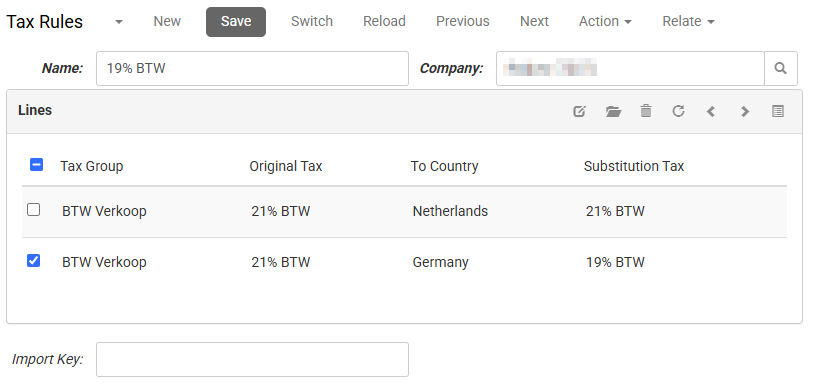

To work with tax rules, in the CloudSuite App go to Other Settings > Taxes > Tax Rules. An overview appears, listing all tax rules that have already been defined. Double-click an existing rule to open its details or click New to create a new one.

- Enter a Name for the tax rule. This will not be visible to customers.

- Select for which Company the tax rule should be active.

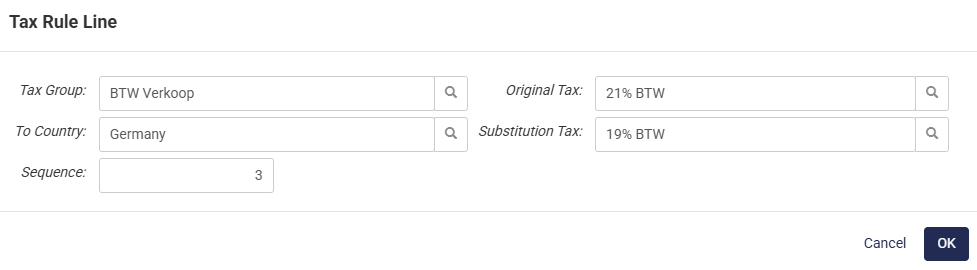

You can create multiple tax Lines within a tax rule to set different taxes (per country).

- Select a Tax Group. Tax groups are defined separately.

- The Original Tax is the tax that you want to overrule with this tax line. When the Original Tax is filled, the tax rule will only count for this tax.

- Next to To Country, select the country where the products are shipped to.

- The Substitution Tax is the new tax that will overrule the Original Tax for the country selected in this line.

- A Sequence number gives control over the order in which tax rules are applied.